by Jennifer O'Donnell

Poverty alleviation is one of the five priorities for improving health in Mendocino County. Poverty has a profoundly negative impact on health. Nearly 30% of the county’s children live below the federal poverty level, compared to 23% in California, and 57% are eligible for free lunch. Twenty percent (20%) of county residents live in poverty, compared to 15% in the state. Seniors, a growing segment of the population, are also at risk. Too many local jobs don’t pay enough to cover basic expenses, and individuals and families are struggling to make ends meet.

One of the strategies of the Poverty Action Team is to help expand access to the Earned Income Tax Credit (EITC) by encouraging residents to utilize United Way's Earn It! Keep It! Save It! (EKS) free tax preparation services and properly claim the EITC and other tax credits.

The EITC is proven to be one of the most effective tools to help individuals and families climb out of poverty, but many people are unware that it is available to them.

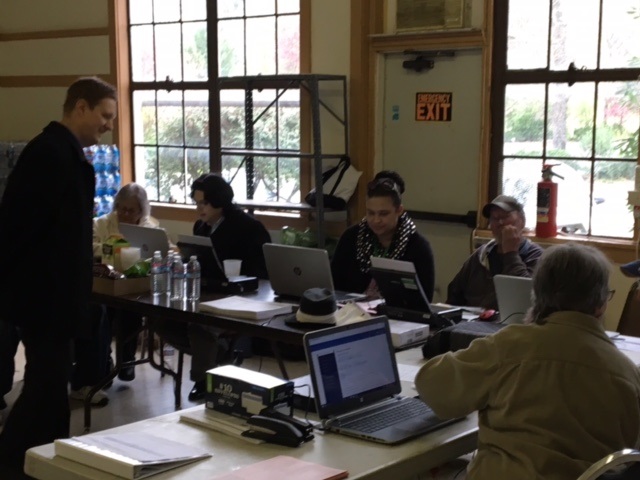

This past tax season, the United Way led the Earn It! Keep It! Save It! (EKS) coalition which includes North Coast Opportunities, Mendocino College, Mendo Lake Credit Union, the ARC Family Resource Center, Nuestra Allianza, and Redwood Coast Seniors. They helped nearly 800 individuals and families in Mendocino County file their taxes for free and brought back over $1 million dollars in refunds to our local economy.

This included dollars from the federal Earned Income Tax Credit. Thousands more dollars were brought back this year thanks to a new California Earned Income Tax Credit (CalEITC). At tax sites, families and individuals with combined household incomes of $54,000 or less, receive free tax help from IRS certified tax preparers who are familiar with the latest tax credits available to low-to-moderate income households.

Some of these tax credits, including the federal and state Earned Income Tax Credits and the Child Tax Credit, potentially add up to refunds of $9,000 or more. The average EKS client’s federal refund at North Coast Opportunities was $1,849 and at Nuestra Allianza was $2,417. This extra money makes a real difference to families, particularly when they’re struggling to make ends meet. Both credits help many families take a step up the economic ladder with often the biggest one-time financial infusion they will see all year – an opportunity to save, pay down debt, open a college savings account, or start an emergency fund.

If you are interested in participating in the Poverty Action Team, please contact Patrice Mascolo at Healthy Mendocino, 467-3228 or healthymendocino@ncoinc.org. To learn more about United Way's Earn It! Keep It! Save It! or the Earned Income Tax Credit, please visit www.unitedwaywinecountry.org.

###

Jennifer O'Donnell is the Vice President of Community Benefit at United Way of the Wine Country. Jennifer oversees all of United Way’s programs and investments in the community. Jennifer has over twenty years experience working in non-profit advocacy, communication, education and program management. Prior to her work with United Way, Jennifer coordinated the national Safe School Ambassadors bullying prevention program for the non-profit organization, Community Matters.